So you want to do some importing or exporting. You've got a product, you've got a buyer, and you've got a shipping container lined up!

But do you understand the Harmonized System and Harmonized Tariff Schedule? If not, then your products aren't leaving the dock.

Customs officers all over the world use The Harmonized System (HS) and the Harmonized Tariff Schedule (HTS) to identify the duty and tax rates for specific types of products. It was developed in 1988 and continues to be maintained by the World Customs Organization, an independent intergovernmental body.

Harmonized System (HS) Code

The Harmonized System classification is a six-digit standard, called a subheading. This is used for classifying globally traded products.

Harmonized Tariff Schedule (HTS)

HTS (Harmonized Tariff Schedule) codes are product classification codes between 8-10 digits. The first six digits are an HS code, and the importing countries assign the subsequent digits to provide additional classification. U.S. HTS codes are ten digits and are administered by the U.S. International Trade Commission.

The best way to tell the difference between an HTS and an HS code? Look at how many numbers the code has.

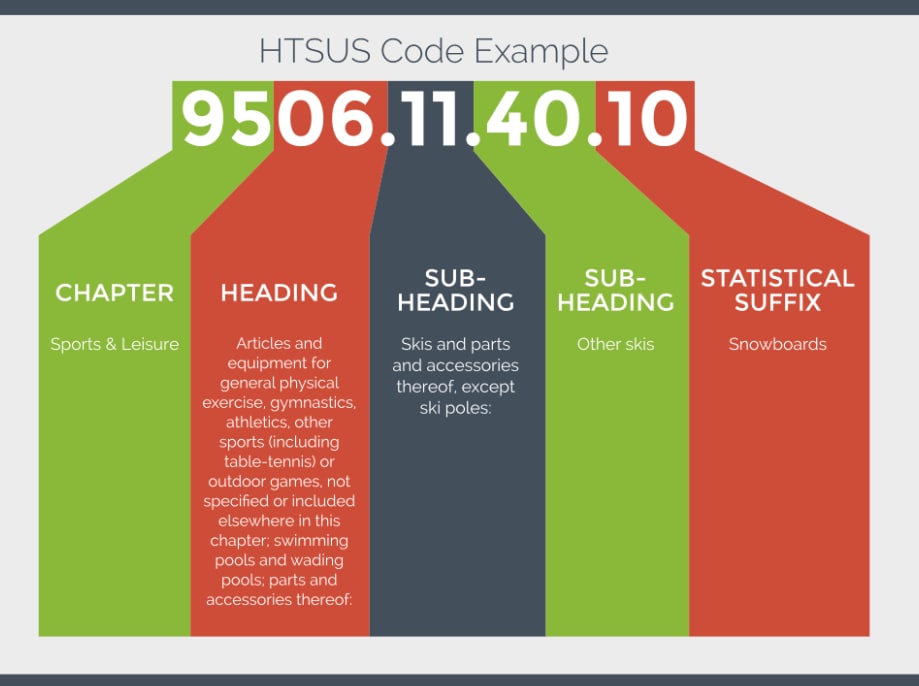

Example: HTS Codes

Global and U.S. HS Codes have four components identified by the green numerals beneath the digits.

- Chapter: In this example, 66 is the chapter.

- Heading: In this example, 6603 is the heading. The heading dictates the specific category within any particular chapter.

- Sub-heading: 6603.20 is the subheading. The last two digits of the international Harmonized Code are more specific, defining subcategories of products.

- Extra digits: 6603.20.3000 is the extra digits. Countries can use an additional 2-4 digits for country-specific categorizations. For example, the United States relies on 10digits codes called HTSUS numbers.

Here's an example of the breakdown of HTSUS numbers:

HS and HTS Codes Purpose

There are a variety of reasons why HS and HTS codes are used by customs and logistics providers. They're most commonly used to calculate duties in tariffs. However, they can also be used to ensure an importer isn't bringing in any banned or hazardous products.

But this all seems so complicated, you say. Why do I need to know all of these numbers? What could go wrong if the customs agents don't actually know what's in my boxes?

You need to know about HS and HTS codes because if you mislabel your boxes, there are serious consequences. In fact, you will be committing fraud! This means fines and penalties.

Luckily, there are plenty of great resources available! If you don't know your product's HTS code, a quick Complete list. And once you have your code (or if you already knew it), you can calculate your shipping rates using one of the free calculators available online!